Most strategists do anticipate issues to search for a bit however a decisive turnaround appears to be like elusive

Article content material

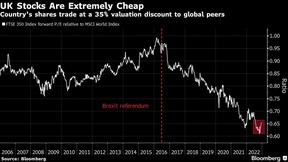

After a decade of abysmal returns and a multi-billion-dollar funding exodus, the wait is on to see if 2024 would be the 12 months Britain’s inventory market breaks out of its downward spiral.

Most strategists do anticipate issues to search for a bit for a market with the most affordable shares within the developed world. But a decisive turnaround appears to be like elusive.

Article content material

For one, they’ve been repeatedly dissatisfied: London’s FTSE all-share index has lagged international equities in 9 of the previous 10 years in greenback phrases. In 2023, it has inched up two per cent, whereas euro-area and U.S. friends notched double-digit positive aspects. And for the reason that 2016 Brexit vote, a complete of US$100 billion has fled U.Ok. inventory funds, Barclays PLC estimates, citing EPFR Inc. knowledge.

Commercial 2

Article content material

The result’s a “self-fulfilling” prophecy that retains the market trapped in a cycle of outflows and losses, stated Jerry Thomas, head of worldwide equities at Sarasin & Companions LLP.

He expects an uptick in 2024, as rates of interest fall and traders funnel some cash out of U.S. Large Tech. Analysts surveyed by Bloomberg Information anticipate the FTSE 100 to complete subsequent 12 months 5.9 per cent above its Dec. 6 closing value — on par with forecasts for the S&P 500. However the broader hurdle stays.

Article content material

“It’s troublesome to search out consumers for U.Ok. equities,” Thomas stated. “There are fixed outflows from U.Ok. fairness funds, so fund managers are having to promote, miserable the market much more.”

It’s all taken a toll on the U.Ok. market’s worth, which has dropped by a fifth previously decade, at the same time as a worldwide index compiled by Bloomberg had an 80 per cent capitalization soar. Paris overtook London final 12 months as Europe’s largest bourse, whereas Mumbai, which surpassed it in measurement in 2021, is already US$1.1 trillion greater.

Extra dangerous information emerged on Dec. 15, as the primary investor in Pearson PLC recommended the writer ditch the FTSE 100 and checklist in New York.

Article content material

Commercial 3

Article content material

“A 3rd 12 months of a comparatively static outlook appears to be like seemingly for the FTSE 100,” Bloomberg Intelligence strategists Tim Craighead and Laurent Douillet stated in a observe on Dec. 18. “The opportunity of fading rates of interest could also be a problem for its banks and insurers, China looms giant for the miners, and sterling’s energy can harm worldwide earnings.”

Nonetheless, traders say they do discover alternatives in the UK, the place shares in big multinationals typically commerce cheaper than overseas-listed friends. Priced beneath 10 occasions ahead earnings — virtually half the place the S&P 500 trades — Britain will lure cut price hunters in some unspecified time in the future, lightening the gloom, they anticipate.

Optimists level to the prospect of Financial institution of England fee cuts in 2024, which might ease a brutal cost-of-living squeeze and property stoop.

Schroders PLC fund supervisor Matthew Bennison lately elevated his holdings of U.Ok. home shares, predicting them to learn from decrease rates of interest. Given “screamingly low-cost” share valuations, “this space of the market appears to be like poised to carry out very nicely over the following three to 5 years,” he added.

Commercial 4

Article content material

With borrowing prices poised to slip, Sharon Bell, European strategist at Goldman Sachs Group Inc., withdrew a advice to short-sell British actual property shares. However she acknowledged the FTSE’s longer-term malaise.

“The U.Ok. inventory market suffers from a scarcity of dedicated home traders,” Bell stated in a observe. “We predict this accounts for a number of the low cost.”

That vulnerability was underscored lately by official knowledge that confirmed pension funds’ holdings of U.Ok. equities had dwindled to 1.6 per cent on the finish of 2022 — a brand new document low.

The variety of U.Ok.-focused open-end funds and exchange-traded funds tracked by Morningstar Direct has shrunk to 463, down from 484 on the finish of final 12 months. The tally a decade in the past was 542.

Lacking tech

Chipmaker Arm Holdings PLC’s selection of New York for its inventory market debut was a serious blow this 12 months for the FTSE, which is already missing in high-performing expertise shares — London accounts for simply 4 per cent of the Stoxx 600 expertise index.

Nor does it have the engineering and luxurious items multinationals that boosted Frankfurt and Paris to document highs this 12 months.

Commercial 5

Article content material

“These sectors have structurally-higher earnings development than the remainder of the market, as they profit from secular themes like synthetic intelligence and electrification,” Nataliia Lipikhina, head of EMEA fairness technique at JPMorgan Personal Financial institution, stated.

For that motive, she prefers European markets to the FTSE, which is dominated by vitality and miners.

Associated Tales

UBS World Wealth Administration additionally expects London’s sector composition to tug on earnings. Regardless of seeing some eight per cent upside subsequent 12 months for the FTSE 100, UBS has been allocating away from U.Ok. shares, seeing their outlook as weaker than many different markets, stated Kiran Ganesh, a multi-asset strategist.

On the finish of the day, Britain has turn into “a considerably remoted market within the context of a worldwide portfolio, which traders exterior of the U.Ok. don’t really want to trouble with,” he stated.

— With help from Sagarika Jaisinghani and Sujata Rao.

Article content material