This text is reserved for our subscribers

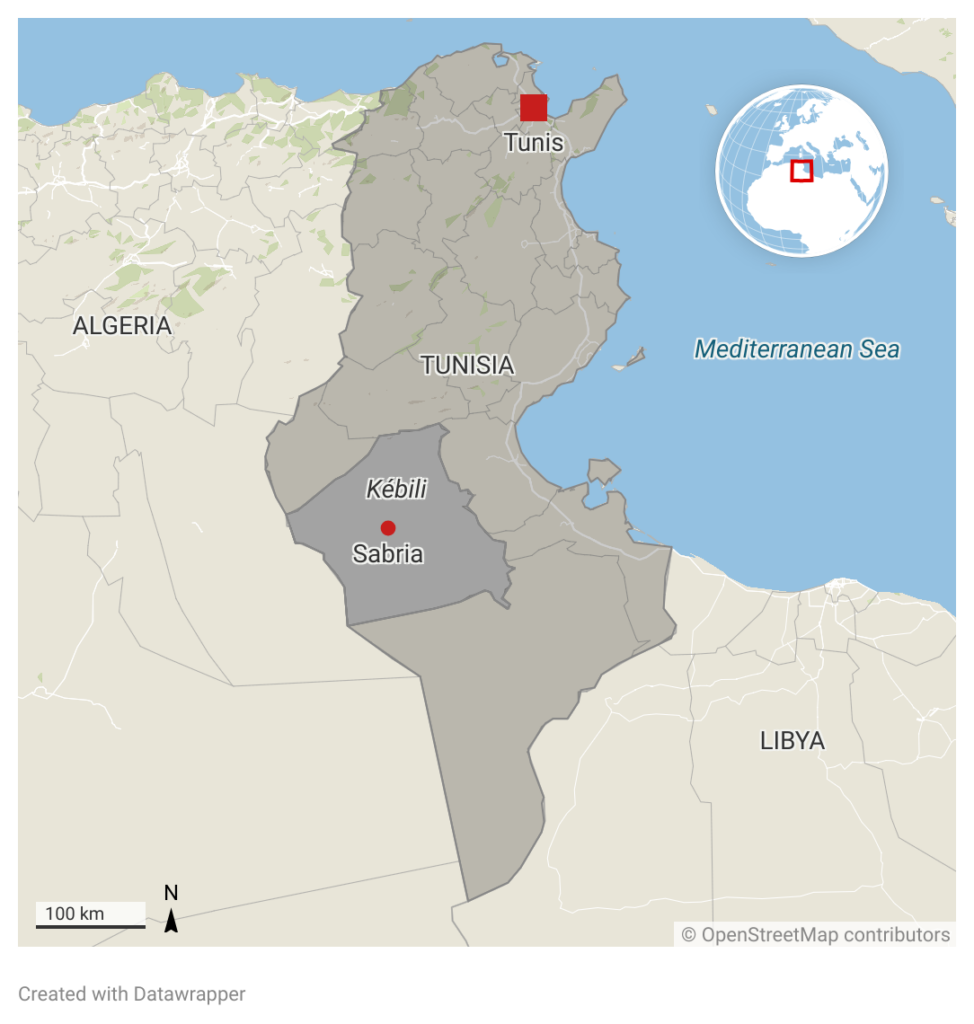

It is exhausting to think about that the panorama of Kébili, close to Douz, on the gates of the Tunisian Sahara, is dotted with gasoline and oil wells. A protected wetland, the world is well-liked for its eerie panorama of pale salty water puddles set in the midst of the desert.

Nevertheless it was right here, within the Kébili area, that the websites of the Jersey-based French oil corporations Perenco and Serinus had been confronted in 2017 with repeated strikes and sit-ins organised by native civil society, which has been calling for higher social and environmental monitoring of the 2 international corporations working in Tunisia since 2012.

The protest led to the signing of a 114-point settlement with civil society teams. However the extraction websites had been categorised as “navy zones”, which prevented any try at protest – or certainly at monitoring the actions of oil and gasoline corporations.

After Perenco, which was taken to court docket in France in November 2022 by the associations Sherpa and Mates of the Earth for the air pollution attributable to its actions within the Democratic Republic of Congo, it’s now the flip of the corporate Serinus.

Registered in Jersey (an island between the UK and France, thought of by some international locations to be a tax haven), the corporate controls Winstar, the Tunisian operator answerable for exploiting the Sabria oil subject in Kébili, whose extraction practices are equally doubtful.

A “small firm” owned by a Polish vitality big

The fracking approach entails injecting water, combined with tons of of poisonous components, at very excessive strain. This chemical resolution could cause critical air pollution of any groundwater layers that could be intersected by the drilling course of.

Such operations can even have an effect on native seismic exercise. That is as a result of depth of the focused oil reservoirs, which may be situated greater than 3000m underground.

Fracking has been the topic of heated debate in Tunisia for years. In 2012 the enormous Shell was pressured to desert plans to drill 742 shale wells in Kairouan after a wave of native protests.

The apply has lengthy been related to shale extraction, however additionally it is used to extract so-called “compact” oil and gasoline reservoirs only a few metres away from shale-rich supply rocks. This “unconventional hydrocarbon” is much less acquainted to the general public than shale gasoline.

The extraction processes for shale deposits are similar to these for compact deposits, each by way of expertise and the environmental dangers concerned. In Tunisia, this linguistic subtlety and the absence of authorized definitions are sure to learn oil and gasoline operators.

The time period “nicely stimulation jobs”, moderately than fracking, is a means of avoiding controversy. However the extraction course of is as unconventional as that used for shale gasoline.

Fracking and unconventional exploitation

Compact oil and gasoline has much less worrying connotations for the critics of ETAP and its companions. “Semi-conventional” assets are most well-liked to unconventional ones, and fracking jobs have been rebranded by Winstar Tunisia (the native operator) as “stimulation initiatives”.

Nevertheless, in line with a senior petroleum engineer who needs to stay nameless: “There isn’t a such factor as semi-conventional. There’s typical and there may be unconventional. The mere use of hydraulic fracturing is sufficient to qualify these fields as unconventional.”

A former director of Serinus insists of the Sabria concession: “Sure, this concession may be described as ‘semi-conventional’.” It is a class of hydrocarbons that, like shale, is just not outlined by regulation however has already been authorized by the Tunisian authorities.

An internet publish by a former ETAP worker on the skilled social community Linkedin in 2020 was clear about this: “Hydraulic fracturing on semi-conventional oil has already been authorized”.

As for Serinus Vitality, one engineer claimed to have carried out fracking work on behalf of Winstar. When contacted by e mail, the engineer refused to present the precise geographical coordinates of the websites the place these operations had been carried out.

Nevertheless, a 2014 report by Winstar, entitled “Workover and stimulation operations by hydraulic fracturing on typical reservoirs”, factors to impression research carried out additional south within the Tunisian Sahara, on the “Ech-Chouech” concession.

When contacted by our journalists, Serinus Vitality confirmed that hydraulic fracturing had certainly been carried out on its Ech-Chouech concession, however not on the Sabria web site. Right here, in line with the corporate, the reservoirs are “typical”. This view is shared by the EBRD, which was contacted by e mail.

Obtain the most effective of European journalism straight to your inbox each Thursday

Serinus additionally says it distinguishes these operations, which have been “commonplace for the reason that Sixties”, from “extra trendy practices related to shale and unconventional useful resource extraction”.

So far as the EBRD is worried, the Serinus undertaking is encompassed by the Society of Petroleum Engineers’ definitions for typical assets.

Nevertheless, there exist many definitions of “unconventional”. For the US Environmental Safety Company, the mere use of hydraulic fracturing – as was the case for Serinus – is sufficient to qualify an operation as “unconventional”.

Serinus additionally factors out that these fracturing operations had been carried out utilizing the corporate’s personal funds, not the EBRD mortgage.

Fracking “anti-constitutional”

Winstar Tunisia has had an curiosity in unconventional hydrocarbons since at the least 2010. Within the absence of any regulatory framework surrounding the apply, the corporate introduced the event of two experimental wells for shale assets that yr and in 2011. However the depth of the wells (over 3,000 metres) and the geological layer focused show it: these aren’t simply “unconventional” wells; they’re shale performs.

In keeping with Afef Hammami-Marrakchi, a lecturer on the College of Regulation in Sfax, Tunisia’s hydrocarbon code doesn’t but present a authorized framework for the administration of this sort of vitality useful resource.

Even then, the usage of environmentally dangerous extraction methods – resembling fracking or shale exploration – ought to have been topic to parliamentary debate, as stipulated in Article 13 of the 2014 Tunisian Structure. This provision was omitted from the brand new structure promulgated by Tunisian president Kaïs Saïed in 2022.

Serinus’s neighbour within the Sabria subject, the corporate Perenco, used the authorized void to interact in comparable practices within the El Farouar and Djebil Nationwide Park areas, as revealed by Jeune Afrique in 2022.

In 2017, the Tunisian authorities commissioned a research on the authorized and technical prospects of unconventional extraction from the Canadian firm WSP International and the Tunisian SCET. However regardless of an estimated price of two.7 billion Tunisian dinars, the research by no means noticed the sunshine of day, leaving the problem in limbo.

Fuel flaring and expired hydrocarbon licences

Throughout our reporting, we additionally found gasoline flares on the Sabria web site, positioned horizontally in a sand pit, as within the picture beneath. That is one other apply that isn’t regulated by the Tunisian Hydrocarbon Code.

Flaring is the method of burning off undesirable methane, a greenhouse gasoline 25 occasions stronger than carbon dioxide, in accordance to the US Environmental Safety Company.

The corporate can be in authorized limbo over two websites it continues to personal though their licences have expired. In keeping with Hydrocarbon Secrets and techniques, a information printed in 2019, the Sanghar concession – which is 100% owned by Serinus by way of its Tunisian subsidiary Winstar – expired in December 2021 and the location has not been in manufacturing since 2016.

The Tunisian vitality ministry has made no official declaration on the topic and has not requested the corporate to reimburse the quantity spent on decommissioning the location and restoring it to its unique state, as required by the Hydrocarbons Code.

In a forthcoming model of the Hydrocarbon Secrets and techniques, which we had been in a position to seek the advice of earlier than its publication, it’s revealed that the identical downside stays with regard to the Chouch concession. There too the operator is meant to reimburse the closure prices and guarantee rehabilitation.

The information additionally mentions that failure to plug the wells may result in a pure catastrophe within the occasion of an oil or gasoline spill.

The Serinus-Kulczyk connection

In its evaluation of Serinus Vitality’s funded initiatives, the EBRD states that the corporate has repaid nearly 93% of its mortgage, whereas the remaining half has been transformed into shares within the firm for the advantage of the EBRD, to the worth of $3.5 million.

The EBRD has not but replied to our questions. Nevertheless, Serinus Vitality instructed us that as a part of its capital restructuring, the equal of 9.9% of its shares held by the funding financial institution had been offered to unidentified consumers in 2022.

In 2021, the identical yr the undertaking was accomplished (and negatively assessed), Kulczyk Investments offered all of its shares in Serinus Vitality, which had since relocated to the tax haven of Jersey.

The corporate’s shareholders now embrace greater than twenty corporations, together with funding fund Quercus TFI and on-line playing specialist Spreadex Restricted. The latter was fined nearly €1.3 million by the UK Playing Fee final yr for failing to satisfy its company social duty obligations.

Serinus Vitality remains to be run by Lukas Radziniak, a former Polish deputy justice minister (2007-2009) and an in depth “lieutenant” of the Kulczyk clan, by way of the assorted corporations and funding funds he nonetheless manages. These embrace Kulczyk Investments, the previous proprietor of Serinus Vitality.